915,000 accidents in Switzerland: accident risk for women and men is converging

In 2024, around 915,000 occupational and leisure accidents and occupational illnesses were reported to the 22 Swiss accident insurers (UVG). This means that the total number is slightly above the previous year's level - mainly driven by an increase in leisure accidents, while occupational accidents fell again compared to the previous year. This year's focus chapter of the accident statistics shows that the accident risks of men and women are constantly converging - a result of social trends and changing working conditions.

All employees working in Switzerland are compulsorily insured against occupational accidents and illnesses in accordance with the Accident Insurance Act (UVG). Anyone who works at least eight hours a week is also insured against leisure accidents. Jobseekers and people on IV measures are also compulsorily insured against occupational and leisure accidents.

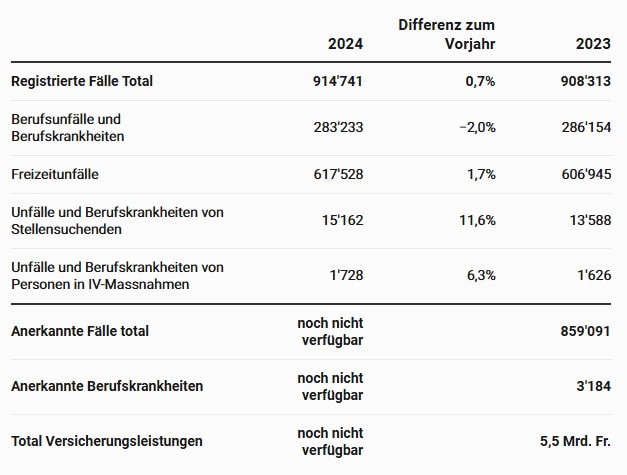

The 22 UVG insurers in Switzerland registered around 915,000 accidents and occupational illnesses in 2024. This corresponds to a slight increase compared to the previous year (+0.7%). The 2.0% decline in occupational accidents and illnesses to 280,000 cases is more than compensated for by the 1.7% increase in leisure accidents to 618,000.

A differentiated picture emerges between the accident insurers: at Suva, the number of occupational accidents and occupational illnesses fell by 3.6%, while the number of leisure accidents increased by 2.1%. In contrast, the other private insurers, which are mainly active in the service sector, saw a slight increase in occupational accidents of 0.8%, while the increase in leisure accidents was 1.4%. These differences reflect the different insured structures and activity profiles in the respective insured collectives.

The current costs for 2024 are not yet fully known. In the previous year, insurance benefits amounted to around CHF 5.5 billion, mainly for medical costs (medical and therapeutic benefits), daily allowances and provisions for disability and survivors' pensions. At 63.5 percent, leisure accidents accounted for the largest share of this, with 33.3 percent attributable to occupational accidents and illnesses, 3.1 percent to accidents involving unemployed persons and 0.1 percent to accidents involving persons on IV measures.

Focus chapter: Demographics are changing the risk of accidents

The focus chapter of this year's UVG statistics sheds light on the effects of demographic change on accidents and shows that the risk of falls for men and women has increasingly equalized over the last three decades.

In occupational accident insurance, this convergence is primarily due to the decline in the risk of accidents among men in higher-risk sectors. The reasons for this are stricter regulations, investments in prevention measures and the growing proportion of administrative activities. The occupational accident risk for women, on the other hand, remained largely stable.

There are also signs of changes in the risk of accidents during leisure time. There has been a clear decline among men, especially younger men, even though they still have the highest accident rate. However, the over-representation has weakened noticeably, to which the increase in road safety has probably contributed significantly. In contrast, there has been an increase in the risk of leisure accidents among women, especially in the 55+ age group. This is mainly due to a change in more active leisure behavior. Overall, the statistics indicate a convergence of accident risks between genders and generations. On the one hand, this is due to the demographic development in the insured population - older and more female. On the other hand, changes in job profiles, prevention efforts and leisure habits are also reshaping the risk.

Accident statistics and source of supply

The Swiss Accident Insurance Statistics Unit (SSUV), which is managed by Suva, publishes the

Annual UVG accident statistics on behalf of the Coordination Group for Accident Insurance Statistics (KSUV). The statistics are based on the results of the 22 UVG accident insurers in Switzerland (Suva, private insurers subject to the Insurance Supervision Act (VAG), public accident insurance funds, recognized health insurance funds, substitute funds), which provide compulsory insurance for employed persons against occupational and leisure accidents and occupational illnesses. Also included are the results of compulsory accident insurance for the unemployed and for persons undergoing IV measures who are insured with Suva.

The UVG statistics do not record accidents involving children, schoolchildren, students, housewives and househusbands, self-employed persons and retired persons. Essentially, therefore, it covers employees and apprentices aged between 15 and 65 who are permanently resident in Switzerland. These people make up a good half of the resident population.

The newly published UVG 2025 accident statistics contain the statistical results on cases in 2024 and on costs and accident events in 2023. The accident statistics are available in printed form and online at German and French available. Individual printed copies can be ordered free of charge from the SSUV: unfallstatistik@suva.ch. Further information: www.unfallstatistik.ch.

Source: www.svv.ch