Soon comes the QR bill

A new era is beginning for Swiss payment transactions. From June 30, 2020, the QR (Quick Response) bill with payment section and receipt will replace the red and orange payment slips. Not only all financial institutions, but also every company must adapt its processing procedure to ensure smooth payment transactions.

Despite the Corona virus - the deadline for the new QR invoice is June 30, 2020. From then on, the first QR invoices may arrive instead of the usual payment slips. Companies that handle their invoicing and payment transactions via accounting software and have not yet reacted should do so urgently: Adjustments need to be made to readers and scanning platforms as well as to accounts payable and payment software so that they are able to receive and pay incoming QR invoices in good time.

Act urgently

The introduction of QR invoicing has a nationwide significance. It affects all companies, government institutions and non-profit organizations as well as all private individuals. Invoice senders can send QR invoices as of the specified cut-off date. Invoice recipients must assume that many of their suppliers will use the opportunity to optimize their processes with the QR invoice. Every company should prepare for this in good time. Those who have not yet dealt with the changeover should contact their bank and software partners immediately. These can support the company in the planning and conversion work. The need for adaptation depends on the hardware and software infrastructure used. Those SMEs that do not use an ERP system do not need to do anything. The necessary conversions will be carried out by the Swiss banks, which will inform their customers in good time.

The QR Invoice

The advantages of the new solution:

- Invoicing in CHF and EUR

- a QR code for all payment methods and references

- the digitization of data enables more efficient payment processing and payment monitoring

- Improved data quality thanks to more and more precise information in standardized form

- Continuously automated payment references from the ordering party to the recipient

The advantages for invoice recipients:

- simplified invoice processing

- all payment information digitally integrated in the QR code

- fewer errors during reading

- Saves time and money because there is less manual effort

- Supports digital payments and payments by mail or at the post office counter

The advantages for billers:

- simplified payment reconciliation, less manual effort

- electronic transmission of all payment information

- Printing on white paper

Payment options

All bill recipients must be able to pay QR bills by June 30, 2020. The following options are available for this purpose:

- electronically with a Business software solution (ERP)

- via Mobile banking: Open mobile banking app on smartphone, scan QR code and initiate payment

- via E-Banking: Open e-banking app, scan QR code and initiate payment

- By mailThe QR-bill also functions like a payment slip (payment part and receipt), which can be paid in at the post office counter or sent to the bank by payment order in an envelope.

Source: SIX Interbank Clearing

A detailed article on QR invoicing is also published by author Markus Mettler, DTI Switzerland, in the latest issue No. 2 of the SecurityForum to read (Request trial subscription). Issue 2 also contains a technical article entitled "Secure payment transactions for SMEs" by Oliver Hirschi, Head of "eBanking - but secure!

The new payment slip

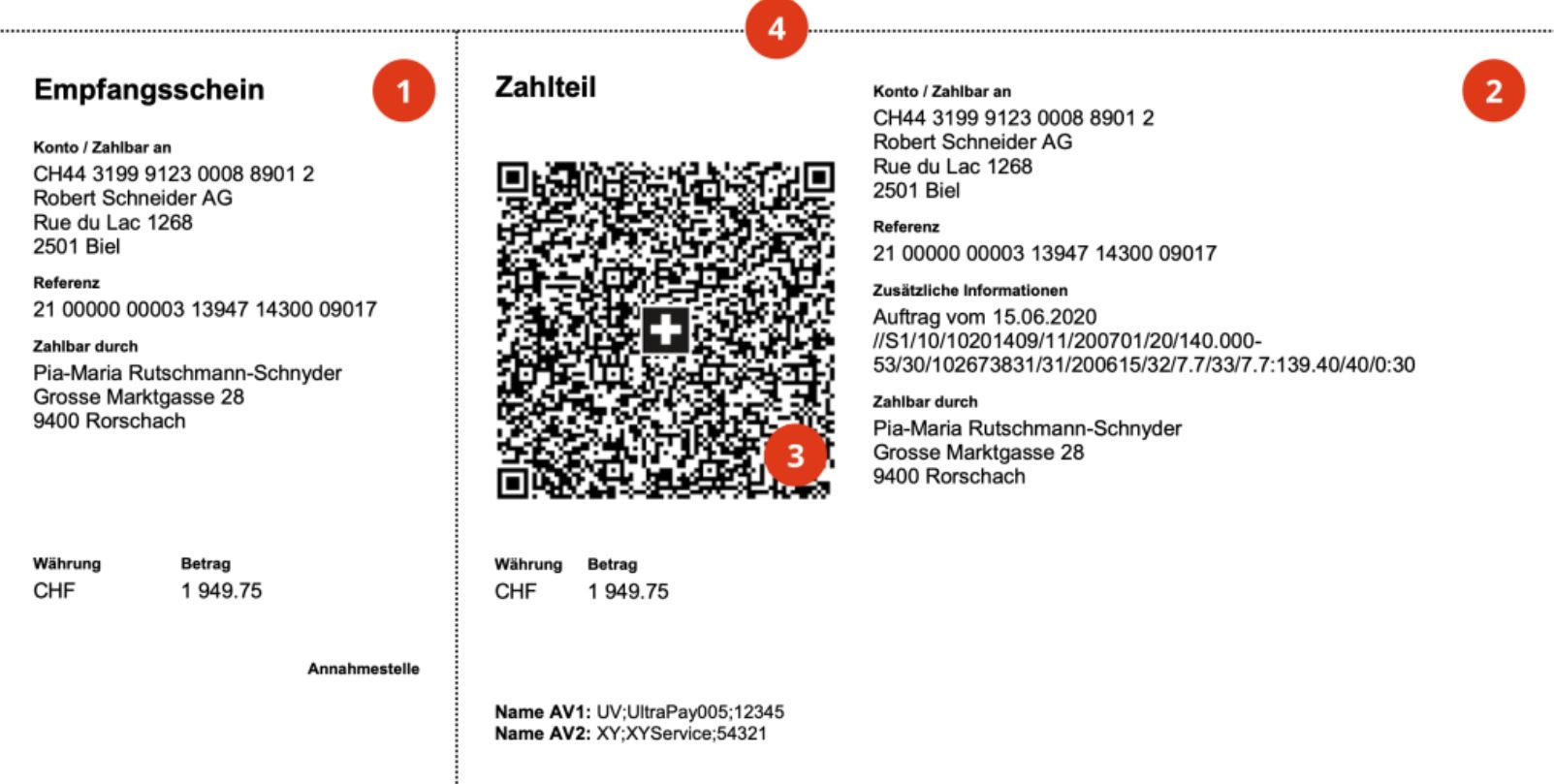

The QR invoice is divided into two parts just like the previous payment slip - a receipt (1) and a payment part (2).

The Swiss QR Code (3) contains all relevant information necessary for both invoicing and payment.

Thanks to the perforation (4), you can conveniently detach the payment section and receipt from the invoice and either pay it in at the post office as before. Or send it to your bank by mail with a payment order.