Evaluate fire protection - for more operational safety

Can existing fire protection be evaluated? Most insurance companies in this country have risk engineers on staff who carry out inspections at medium-sized and larger companies to assess the risk potential with regard to fire.

In order for the responsible underwriter to underwrite the submitted risk, he needs risk-relevant information. In the case of property insurance, this is mainly limited to the risk of fire, natural hazards and burglary or theft. The more and better information he has for his work, the more precisely the premium can be calculated and the more risk-appropriate it becomes.

In order for the responsible underwriter to underwrite the submitted risk, he needs risk-relevant information. In the case of property insurance, this is mainly limited to the risk of fire, natural hazards and burglary or theft. The more and better information he has for his work, the more precisely the premium can be calculated and the more risk-appropriate it becomes.

The best source of risk assessment for the underwriter is the use of a risk engineer, who assesses the risk situation of the prospective or existing customer on site. He or she gathers important information that, once evaluated, is incorporated into the pricing process. For the assessment of the respective company, the engineer prepares a risk report, which for most underwriters also includes a rating system that compares the company being assessed with the industry.

Other advantages of a fire safety assessment system

In addition to providing a basis for premium determination for subwriting, such a system offers other advantages:

- a systematic recording of all significant risk characteristics

- a control of the working method of the risk engineer

- A risk sensitization of the policyholder, which is probably the most sustainable benefit for everyone

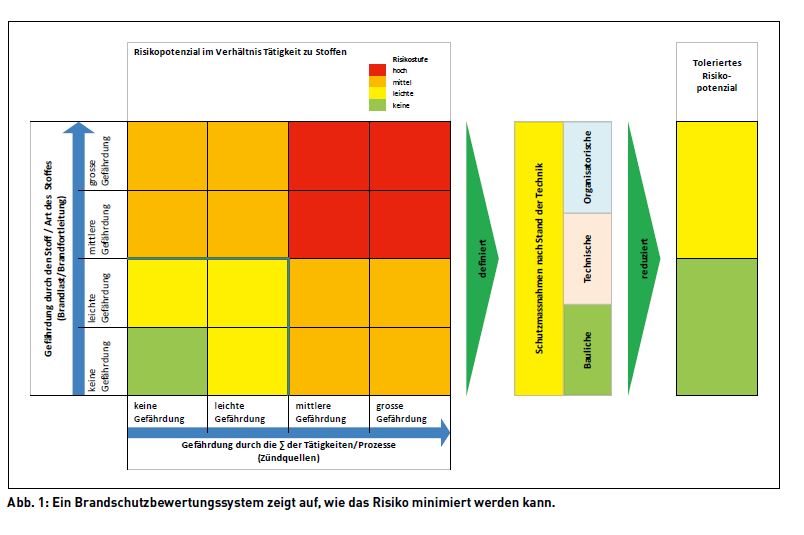

Above all, the comparison with the industry average should be an incentive for the customer to continuously question himself with regard to fire protection and, if necessary, to improve with necessary measures. Together with any recommendations made by the risk engineer, the risk can be minimized in this way (see Fig. 1, above).

Structure of a rating system

In order for an evaluation system to cover all risk characteristics for fire protection, a basic structure must be in place. Since fire protection in industrialized countries is defined by legally binding regulations, for example the VKF fire protection standard (Association of Cantonal Fire Insurers) in Switzerland, it makes sense to structure such a system according to this set of rules. The basic classification is as follows:

- technical fire protection

- organizational fire protection

- structural fire protection

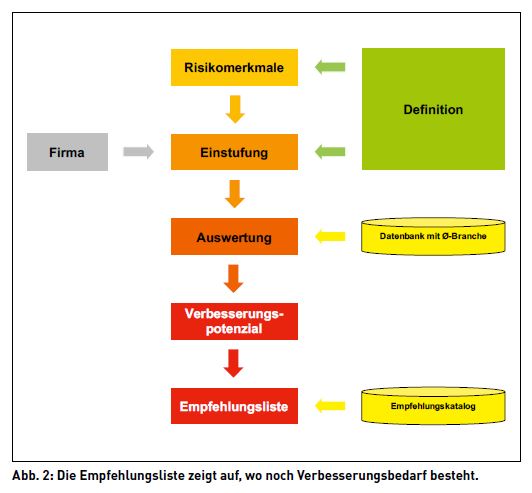

For each of these areas, different risk characteristics were determined, such as for technical fire protection, the sprinkler or the fire alarm system. For each criterion, a clear evaluation scale was stored in a definition, which provides information on the degree to which a fire protection measure is present. Thus, depending on the criterion, a degree can range from "full protection", "partial protection" to "unprotected".

The industries were divided into sectors (e.g. metal or stone) according to the substance or material they process in the core process. At the beginning, the statistics of the insurer were used to evaluate the average per industry and criterion, which is used as a benchmark for the evaluation. All evaluations are stored in a database and the comparative value should be adjusted annually (see Fig. 2).

Fire protection measures are directly related to the activities performed and the materials used in the processes. Within the processes, the individual activities define the ignition sources and the fire load, depending on the flammability and quantity of the materials used. In addition, the companies are differentiated according to the nature of their business, this in

- Production plant,

- Logistics operation,

- Service company.

Thus, the process chains - such as incoming goods, warehouse, order picking and outgoing goods at a logistics company - show a different hazard potential per company orientation. According to the classification, this potential consists of

- the ignition sources,

- the fire load,

- the flammability of the substance,

- the spread of fire

together.

Published statistics were also consulted in the assessment of hazard potential in order to determine an average value per industry.

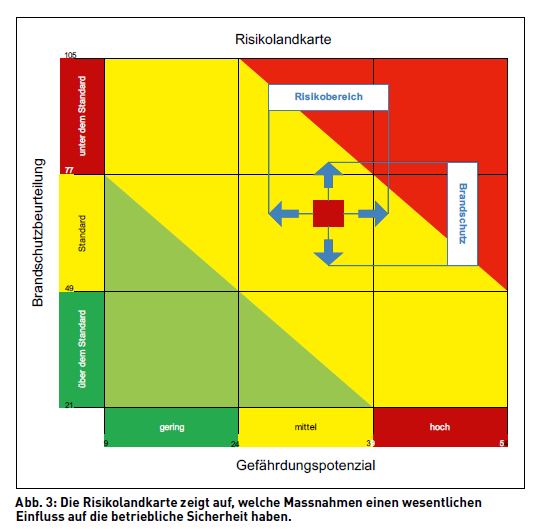

After the assessment by the risk engineer, the audited company is compared with the industry average by means of a risk map. If a company shows a negative evaluation in one criterion compared to the average value of the industry sector, the auditor usually makes a corresponding recommendation, which reduces the risk if implemented.

Recommendation catalog

Together with the risk rating, the customer is given a list of recommendations. In accordance with the basic structure of the evaluation system, text modules for the most frequent complaints are stored per criterion in a recommendation catalog, which can be compiled customer-specifically on a recommendation list. This list also contains references to the desired target states (words and images), including references to the legally binding VKF regulations. On the part of the risk engineer, the recommendations are scheduled according to their urgency by means of a three-stage prioritization and classified according to the expected damage reduction with regard to the extent and probability of occurrence. The status of the implementation of the recommendations is actively requested by the insurers and evaluated annually.

Evaluation

By linking the assessment system with the recommendation catalog, the risk map (see Fig. 3, below) can be used to show the customer which measures have a significant impact on operational safety.

If a company has a wide variety of sites, the individual company evaluations can be combined in a risk map and evaluated against this in terms of an overall view of fire risk. If the evaluations of the individual plants are close to each other, this shows a uniform implementation of the operational safety policy within the company construct.

The risk carrier, i.e. the insurer, can use the stored valuation data to continuously review its business customer portfolio in terms of risk quality and, if necessary, make corrections to its underwriting policy.

Experience in Switzerland

In principle, the risk inspections reveal that companies in Switzerland have good fire protection and generally comply with the applicable VKF guidelines when constructing a building and during operation. The existing building structure is classified as better in the majority of cases compared with the foreign risks, since solid construction is still preferred in this country or is built with higher-quality building materials.

Most recommendations are made in the area of organizational fire protection, namely maintenance and servicing. Technical fire protection with sprinklers, fire alarm or object protection extinguishing systems does not relieve companies of the periodic maintenance and servicing work or inspections. It is important that newly installed fire protection systems are subjected to a 1:1 test and integrated into the existing fire protection concept.

It is also advisable to train the safety organization annually with at least one fire drill including briefing of the fire department. Experience shows that too much time is lost, especially until the start of firefighting. For the most part, the players are overtaxed because they do not have a defined procedure or do not know it, or only know it in theory. It must also be ensured that a deputy is available at all times.

Conclusion

Existing fire protection can be systematically recorded and evaluated. The resulting measures and their implementation improve the safety structure of a company. It would be desirable for such evaluation systems to be available on the Internet on the insurer's customer portal in accordance with the applicable VKF fire protection standards, so that the customer can independently and continuously verify his progress in fire protection. Unfortunately, today such programs are not available at all or only in a limited version.

Author

Reto Bruderer, Dipl. FWT-Ing. HTL, Head of Risk Engineering Services, Helvetia Versicherungen