Earthquake: New insurance tool

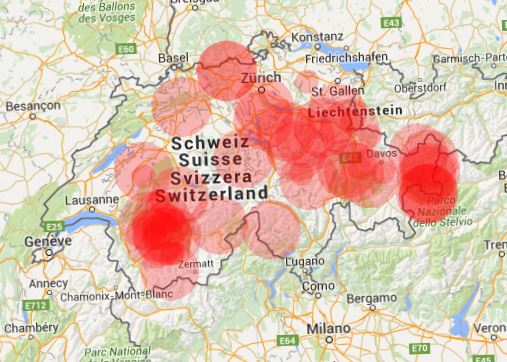

The recently updated earthquake hazard model of the Swiss Seismological Service (SED) confirms it once again: earthquakes, along with floods, are among the greatest natural hazards in Switzerland. Now an insurance company is launching an online tool to insure the house against earthquakes.

Most of the 500 to 800 quakes that occur each year are not noticeable. But according to Flavio Anselmetti, professor of geology at the University of Bern, there are exceptions: "About every hundred years, an earthquake occurs in Switzerland that causes damage to buildings."

Earthquake damage is generally not covered by mandatory fire and natural hazards insurance, with the exception of limited coverage in the canton of Zurich, writes the GVB Privatversicherungen AG. However, risk awareness and the desire for appropriate earthquake insurance is growing steadily among homeowners, as their homes are usually their largest asset. GVB has therefore launched the new insurance tool.

Need for additional insurance

GVB is now taking account of the need for supplementary insurance for earthquake damage. It is expanding its services and is now offering the "GVB Terra earthquake insurance" throughout Switzerland. Via the new online tool, interested parties can register with two mouse clicks at www.erdbebenversichern.ch about the earthquake risk at their place of residence and insure their home in a simple way, the provider writes. The online service is available to homeowners in most of Switzerland.