Dormakaba is well on the way

The first half of the 2016/2017 financial year was successful for Dormakaba. The company thus continued the good development of the first joint financial year following the business combination of Dorma and Kaba that took place on September 1, 2015, the group writes. In the period under review, the group generated consolidated sales of CHF 1173.7 million (previous year: CHF 1135.5 million), representing an increase of 3.4%.

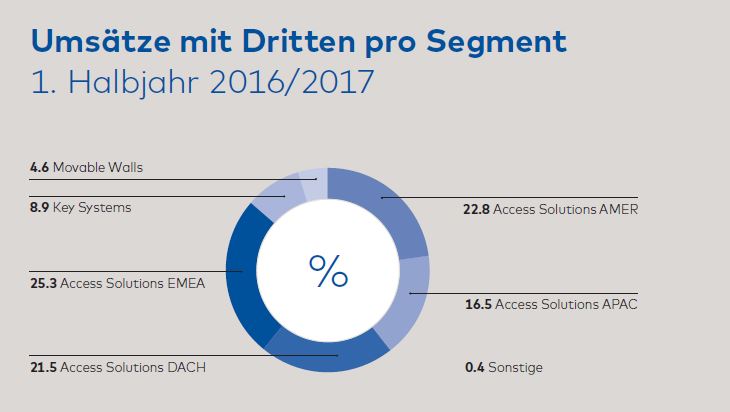

The EBITDA of Dormakaba was increased by CHF10 million (+6%) to CHF175.4 million and the EBITDA margin improved to 14.9% (prior-year period: 14.6%), according to the company. The higher profitability was mainly due to the very good business performance in the Access Solutions Americas, Access Solutions Asia-Pacific and Key Systems segments, the company writes. The detailed report is here to find.

According to Dormakaba, consolidated net income after taxes for the first half of the fiscal year was 95.8 million Swiss francs (previous year: 67.1 million Swiss francs), taking into account that the previous year's figure included one-off integration costs of 34.8 million Swiss francs in connection with the merger.

Cash flow and balance sheet

Cash flow from operating activities amounted to 129.3 million Swiss francs in the reporting period and free cash flow reached -83.5 million Swiss francs. Cash flow from investing activities amounted to CHF -177.3 million and, in addition to the usual investments in fixed assets, included the acquisition of Mesker Openings Group in the reporting period.

According to information as of December 31, 2016, the Dormakaba Group has total assets of CHF 1592.4 million and net debt of CHF 22.6 million.

Outlook

Dormakaba had confirmed its targets of achieving growth of around 3% and an EBITDA margin at around the previous year's level (14.4%) for the current 2016/2017 financial year. The company assumes that the additional integration-related costs, particularly in the areas of IT and branding, will have a greater impact on the operating result in the second half of 2016/2017. In addition, the company confirmed its medium-term targets: Based on the completed merger, the ongoing integration and the Group's operating performance, an EBITDA margin of 18% should be achieved for the first time in fiscal 2018/2019, and growth should be 2% above adjusted GDP growth in the markets relevant to Dormakaba, it concludes.