These regions are particularly affected by storms

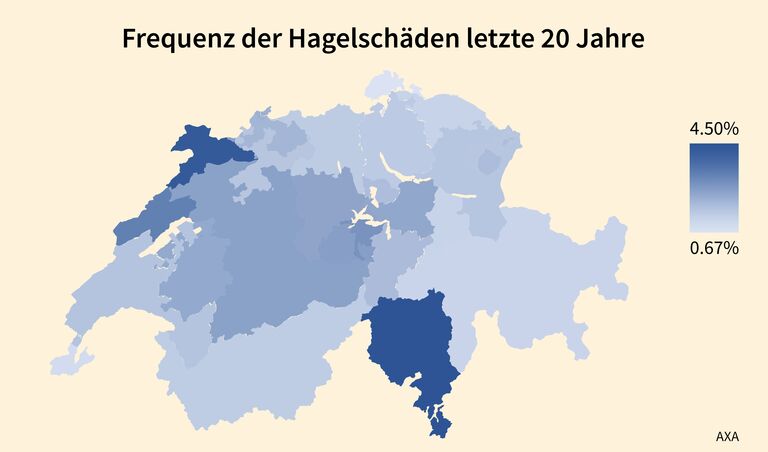

Storms like the ones Switzerland is currently experiencing cause a lot of damage. Last year, AXA recorded storm damage amounting to CHF 132 million, which is in line with the long-term average. However, certain regions stand out in the statistics: hail damage to cars, which accounts for the majority of storm damage, has been particularly high in the cantons of Ticino, Jura and Neuchâtel over the last twenty years.

Source: Axa