Dormakaba presents half-year results

Dormakaba has completed the first half of the fiscal year 2019/20. Organic growth of 0.8% and an Ebitda margin of 15.5% are presented.

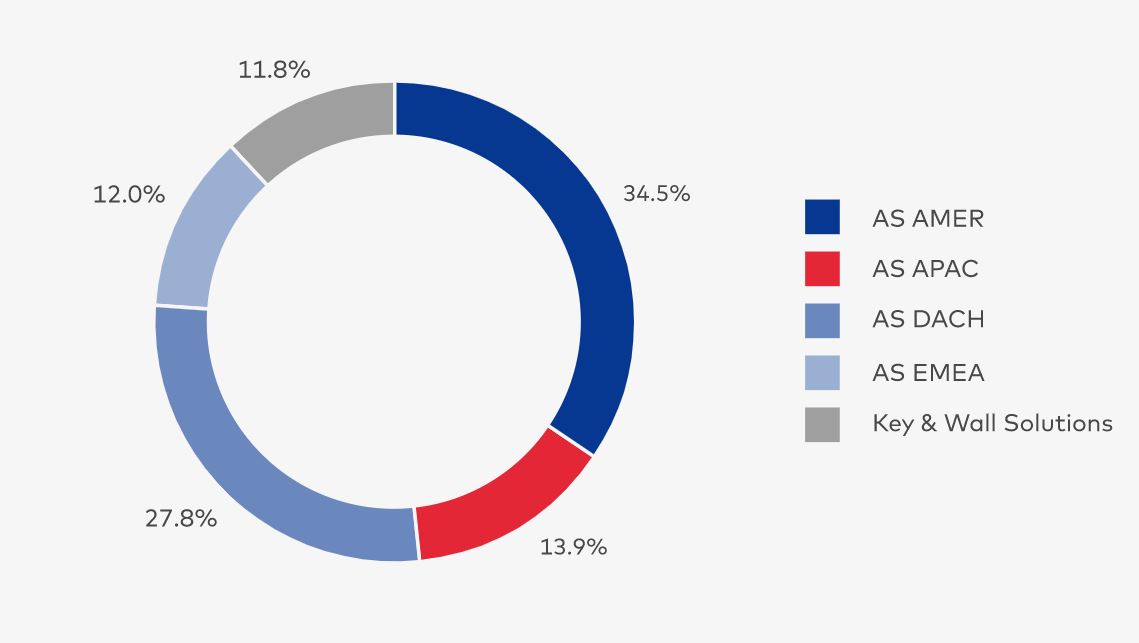

The macroeconomic and geopolitical environment in the first quarter of Fiscal half year 2019/20 continuously even more challenging, writes Dormakaba. The group closed the first half of the fiscal year as of December 31, 2019, with consolidated sales of CHF 1,385.7 million (previous year -0.8%), it said. In addition to the challenging environment, the further appreciation of the Swiss franc against major currencies negatively impacted the result due to currency translation, the company writes. Corrected for the effects of this currency translation (-2.1%) as well as acquisitions and divestments (0.5%), organic sales growth amounted to 0.8%, which represents a slight improvement compared to the second half of the 2018/19 financial year (0.4%).

According to the statement, Dormakaba achieved Ebitda of CHF 214.1 million (previous year 223.0 million), corresponding to an Ebitda margin of 15.5% (previous year 16.0%). The margin was thus slightly below the level of the second half of fiscal 2018/19 (15.8%), the company said. Profit before tax for the period was reported at CHF157.1 million (previous year CHF170.1 million) and net profit was CHF119.4 million (previous year CHF126.7 million).

Cash flow and balance sheet

Cash flow from operating activities amounted to CHF 192.1 million in the reporting period and was thus significantly higher than in the previous year (CHF 149.1 million). The cash flow from investing activities of CHF -191.8 million reflects Dormakaba's continued high level of investment in the further development of its portfolio: it includes CHF -141.4 million for acquisitions and investments of CHF -50.2 million (previous year CHF -45.2 million) in property, plant and equipment and intangible assets, which account for 3.6% of sales (previous year 3.2%).

Dormakaba reported total assets of CHF 1,878.2 million as of December 31, 2019 (Dec. 31, 2018: CHF 1,921.8 million), according to the information. Net debt had increased by CHF 71.4 million to CHF 836.1 million (Dec. 31, 2018: CHF 764.7 million) due to growth.

DACH segment

According to the statement, the Access Solutions DACH segment (Germany, Austria and Switzerland) generated sales of CHF 415.6 million. At CHF 70.3 million, Ebitda was lower than in the previous year (CHF 78.5 million), as was the Ebitda margin of 16.9% (previous year 18.3%).

Outlook

Since the beginning of fiscal 2019/20, the macroeconomic and geopolitical environment has continuously become even more challenging, the group writes. Covid-19 is expected to have a noticeable impact on the 2019/20 annual results, it added. Local demand in China has already been affected, however, visibility on impact on global supply chains and economic growth is currently lacking, it added.

In addition, the macroeconomic slowdown, political volatility and trade conflicts are expected to continue to weigh on business in the second half of fiscal 2019/20. Therefore, from today's perspective, the company expects organic sales growth and Ebitda margin for the full fiscal year 2019/20 to be slightly lower than in the previous year, rather than higher, Dormakaba concludes in its media release. (SF)