GVZ with lower overall loss amount

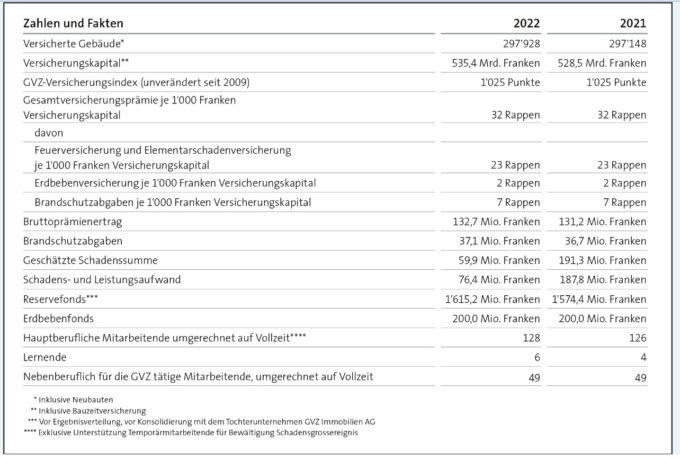

GVZ Gebäudeversicherung Kanton Zürich can look back on a moderate claims year. There were no major loss events in 2022, which meant that the estimated total loss of 59.9 million Swiss francs was significantly lower than the 191.3 million Swiss francs in the previous year.

The GVZ recorded significantly fewer claims in 2022 than in the previous year, as the building insurance company writes in its media release. It processed a total of 3,325 claims (previous year: 22,191), of which 1,122 were fire claims and 2,203 natural hazards. The total of estimated fire damage amounts to 48.6 million Swiss francs (previous year: 57.3 million Swiss francs) and is thus within the range of the 10-year average. Natural hazards damage was reported at 11.3 million Swiss francs (previous year: around 134.0 million Swiss francs), well below the previous year. In this area, many damage reports had come from the communities of Zell and Turbenthal (Tösstal). Both were affected by heavy rainfall and subsequent flooding at the beginning of May 2022.

Increase in gross premiums

Gross premiums increased by 1.14 percent year-on-year to 132.7 million francs, GVZ said. At the same time, fire protection levies increased to 37.1 million francs (previous year: 36.7 million francs), it said. The increase was related to the ongoing construction activity in the canton of Zurich and the corresponding increase in insurance capital, it said. The fire protection levies included in the insurance premium would serve to finance preventive and defensive fire protection measures as well as financial support for the fire departments in the canton of Zurich.

Investment portfolio with minus

High inflation rates, energy shortages, fears of recession, and the Russia-Ukraine war were the dominant factors that caused both equity and bond markets to fall sharply in value globally, according to the GVZ release. As a result, GVZ's broadly diversified investment portfolio was also exposed to the fluctuations in the financial markets, it said. After an above-average total return of 7.4% in the previous year, the return of the GVZ investment portfolio in the reporting year 2022 is -10.1%.

Due to the weaker investment result, GVZ closed the financial year with a loss of 51.1 million francs (previous year: profit of 41.4 million francs). According to GVZ, the loss will be charged to the reserve fund. Thanks to adequate reserves, the company continues to have sufficient funds to cover financing requirements arising from loss events at any time.

Lower premium - higher insured value

The GVZ reduced the building insurance premium from 32 centimes to 29 centimes per 1,000 francs insured value (19 centimes insurance, 2 centimes earthquake insurance, 8 centimes fire protection levy (previously 7 centimes)). This complies with the requirements of § 42 of the Law on Building Insurance (GebVG), writes the building insurance. The reduction in premiums approved by the government council in resolution no. 1171/2022 compensates for the increase in the GVZ insurance index from 1,025 to 1,130 points. GVZ customers would pay slightly less overall for the insurance of their house property with about 10 percent higher insurance value.

Source: GVZ