Natural disasters 2019 accounted

Right now, the world is in a Corona stranglehold and may not care about other natural disasters just yet. But what will the global natural catastrophe balance look like in 2019?

Globally, economic losses from natural disasters ($137 billion) and man-made disasters ($9 billion) totaled $146 billion last year (2018: $176 billion). That's according to the Swiss Re Institute's latest Sigma Study 2/2020, "Natural Catastrophes in Times of Economic Accumulation and Climate Change Risks." The latest figures are thus below the 10-year average of USD 212 billion. The global insurance industry covered USD 60 billion of the losses (2018: USD 93 billion).

Main driver severe weather events

Severe weather events were the main driver of overall losses in 2019. Swiss Re expects economic development and ever-increasing population concentrations in urban centers, as well as climate change, to further increase losses due to weather events in the future. Its industry could play a key role by working with clients and governments to develop solutions that would support the transition to a low-carbon world, it said, citing renewable energy projects.

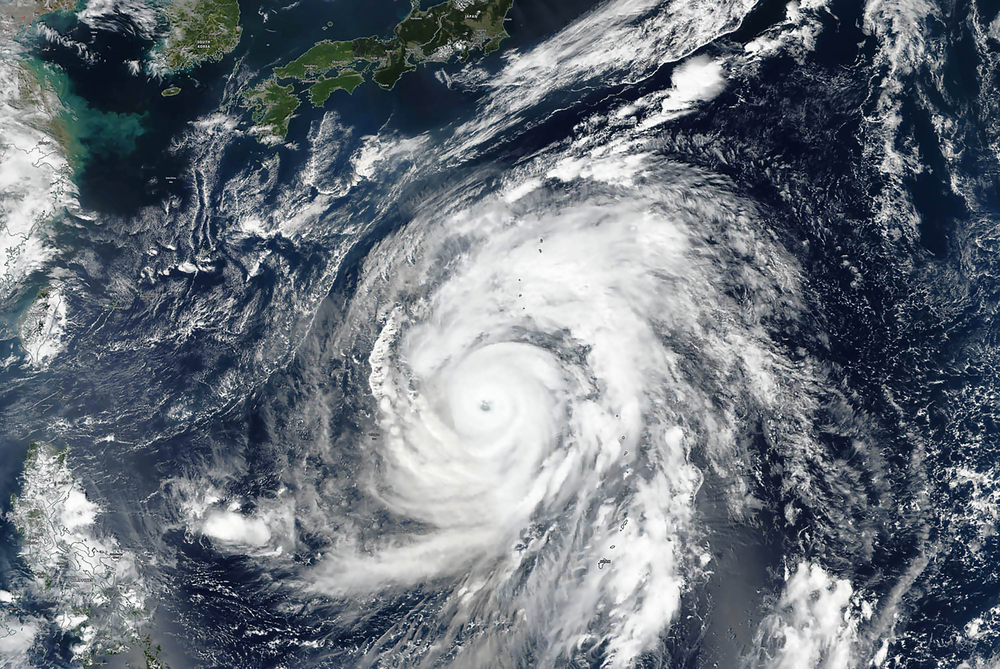

The largest industry loss events of 2019 occurred in densely populated and developed parts of Japan: Typhoon Faxai in September (insured losses of $7 billion); followed by Typhoon Hagibis in October (additional insured losses of $8 billion).

Immediate action is called for

According to the study, economic development and population expansion lead to changes in land use, such as deforestation and construction of floodplains and the wildland-urban interface. Another variable is the extent of risk mitigation infrastructure such as flood barriers and sea defenses. These all influence the extent of losses caused by extreme weather events and other natural disasters, he said.

It is difficult to quantify the exact impact of rising temperatures on specific weather-related disasters, but climate change is a threat that requires immediate action because of its severe impact on human life and the global economy, said Jerome Jean Haegeli, group chief economist at Swiss Re.

The effects of climate change are already apparent and include rising sea levels, longer and more frequent heat waves and erratic precipitation patterns, Swiss Re writes. Warm temperatures would likely lead to an increased frequency of extreme weather events, the report says. The damaging effects manifested themselves primarily in secondary hazards, as was evident in each of the past three years. In particular, in 2019, rainfall caused by Typhoon Hagibis, flooding caused by storm surges from Cyclone Idai in Mozambique, and monsoon rains in Southeast Asia, as well as other weather systems, caused economic and humanitarian damage. Record high temperatures in eastern Australia caused wildfires to burn across millions of hectares of bushland in the longest forest fires the country has ever seen.

Weather risks remain insurable

Overall, the Swiss Re Institute believes that weather risks remain insurable with adaptation measures. According to reinsurers, the insurance industry must adapt to a dynamic risk landscape by accurately incorporating socioeconomic developments, the latest scientific research on climate change impacts, and the status of local risk mitigation measures into its modeling. Many of today's catastrophe models are compared to historical loss data that does not reflect current levels of urbanization, and therefore do not fully account for today's rapidly increasing exposures, changing socioeconomic environment and climate, it further states.

"To maintain the insurance risk transfer model as a powerful tool to promote resilience, insurers need to adapt before rather than after events," said Martin Bertogg, head of Catastrophe Perils at Swiss Re. "To that end, insurers should be wary of historical loss records to understand the state of the socioeconomic environment and climate today. Averaging over several decades can lead to a biased risk assessment."

Typhoon Hagibis is a case in point. Japan has always been exposed to a high typhoon risk, and with huge investments in coastal and inland flood protection following the devastating typhoon events of the 1950s and 1960s, the reinsurance industry would have considered the flood risk in Japan to be largely mitigated. However, most of the $8 billion in insured losses from Typhoon Hagibis stemmed from flooding, and due to urban development since the mid-20th century, Tokyo was not prepared for the level of physical damage, Swiss Re points out.

"While flood protection prevented major devastation in parts of the greater Tokyo area, at least 55 levee breaches and overflowing rivers showed that the risk of water flooding is only partially mitigated," Bertogg said. "Flood protection has mitigated the effects, but by no means completely."

The English version of the Sigma 2/2020 "Natural Disasters in Times of Economic Accumulation and Climate Change Risks." is available for download.