Profile of a white-collar criminal

As KPMG's "Profile of a fraudster" forensics study of fraud cases (March 2013 to August 2015) shows, 24 percent of 750 cases were aided by technological means. However, the profiles of white-collar criminals vary. As KPMG forensic experts point out, a majority of frauds are due to inadequate reporting systems or weak control systems.

White-collar crime causes billions of euros in damage. In Switzerland, too, numerous companies suffer from such activities. More and more, tech-savvy fraudsters are using contemporary technological means to carry out their schemes, as the Study shows.

Of all cases investigated in this country involving technology, about 27 percent involved billing documents with false or misleading information, and another 27 percent involved the creation of fraudulent emails. Economic frauds (Engl.: Frauds) are diverse, with 47 percent directly targeting assets and "only" 22 percent involving manipulation of data

KPMG attributes the fundamental increase to a registered 750 fraud cases (in 81 countries) to a higher use of technology on both sides: for example, between the client and the service provider, but certainly between corporate partners and high-level criminals.

Another 9 percent of technological frauds between March 2013 and August 2015 represented the pervasive abuse of existing access rights to computer systems. Fraudulent manipulations tend to be committed more often by groups (62 percent) than by individuals (38 percent).

The typical scammer

The typical white-collar delinquent in Switzerland is between 46 and 55 years old, male and executive (member of senior management). "They are often self-important, but seem friendly," pointed out Philippe Fleury, head of forensics KPMG Switzerland. In the study, 17 percent represent female fraudsters. They tend to act as inconspicuous staff members, unlike male delinquents in the cadre.

Compared to study data from other countries, the typical white-collar delinquent in Switzerland is also a good ten years older than foreign fraudsters. Moreover, 36 percent of this genre had already been with the same company for six years. The KPMG forensic experts therefore see risk potential among existing employees and corporate partners: "It is difficult to identify individual perpetrators. In Switzerland in particular, there is a high culture of trust."

"Here," says Mathias Kiener, Partner Forensics KPMG Switzerland, "it is usually only the commissioner coincidence that works." In addition to undetected individual perpetrators, the fraud typology also includes indefinable collusion and yet many-sided organized rope teams and "entire incriminated management groups.

Typical profile picture in Switzerland

For Switzerland, the following profile picture of the typical economic delinquent emerges:

- More than half of the investigated fraudsters are between 46 and 55 years old.

- 82 percent of the perpetrators are male.

- 64 percent of all fraudsters come from within the company's own ranks.

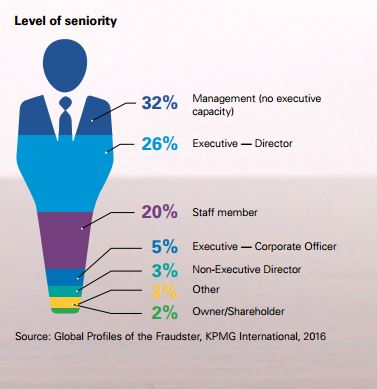

- 55 percent of the perpetrators are cadre members.

- 36 percent have been employed by the company for at least six years (2013: 41%).

- The main motives for committing fraud are personal enrichment to finance lifestyle (64%), greed (18%), and a sense of curiosity/ease of doing the deed (18%).

Control systems insufficient

According to KPMG forensics, fraud and threats have grown as a result of weaker controls. For 64 percent of all white-collar offenders, weak internal controls are a key driver that appears to be growing in importance: the number of fraudsters whose criminal activity is significantly facilitated by weak controls has increased sharply from 18 to 27 percent compared to 2013.

Astonishing is the fact that at most 13 percent of all fraudsters felt under pressure from an organization to take a criminal path. Another finding of the study: at most 3 percent of all frauds can be collected through "pro-actitve data analytics," and just 6 percent of abuses are detected by external auditors.

While criminals are already making very efficient use of technological tools, companies are doing little to curb crime with technological means on their part.

Philippe Fleury, Head of Forensics at KPMG Switzerland, warns: "The use of technology in white-collar crime will continue to increase. Improved control and threat monitoring systems are therefore a must for companies to detect irregular or suspicious behavior in time."

Conjectures and hints

However, even the best controls do not completely protect against economic fraud: In 16 percent of the cases investigated, it was possible to circumvent control systems. In another 20 percent, these played no role at all; the perpetrators were not distracted by the control mechanisms and carried out their frauds without regard to them.

Detection of such acts occurred 44 percent through complaints or tips and 22 percent as a result of identifications or analysis by management.

Text: Michael Merz